![]()

On The Way To The Bottom

By Paul Lamont

October 31, 2008

As we stated last October (the month of the stock market’s peak); “the stock market is a sideshow, it can adjust to the economic reality very quickly as it did in 1929 (especially with credit losses already in place).” Only misconceptions about the Great Depression cause a dismissal of the similarities. Commodities are correcting sharply as forecast. The U.S. Dollar has gained double-digits against other currencies while the Yen is “soaring to 13 year highs.” The U.S. stock market (DJIA) has fallen below the ‘line in the sand’ described in March. European countries are faring much worse as expected. Even our forecast for Mega Thrift is becoming more plausible. Retail investors are still looking for bargains (“What can I buy?”). But they are merely providing the fuel for the market to move lower. The smart money has to have someone to continually sell to.

“What lessons can we learn from any investments over the last 1,000 years? That economic, social and political change would appear to have been the only constant. That great investments at one time turned out to be disastrous at others and failed in the long run…At all times, therefore, the opportune selection of the “right and undervalued investment theme” was of crucial importance – as was the speedy abandonment of fully valued popular themes that were bound to underperform….Finally, it strikes me that – as all the great philosophies and religions have argued – material goods are impermanent, whereas human instincts, beliefs, ideas, ethics, senses, and emotions hardly change: a fact that accounts for the enduring nature of religious, philosophical and educational institutions, as well as periodically recurring investment manias.” – Dr. Marc Faber, Tomorrow’s Gold.

How Low Can It Go?

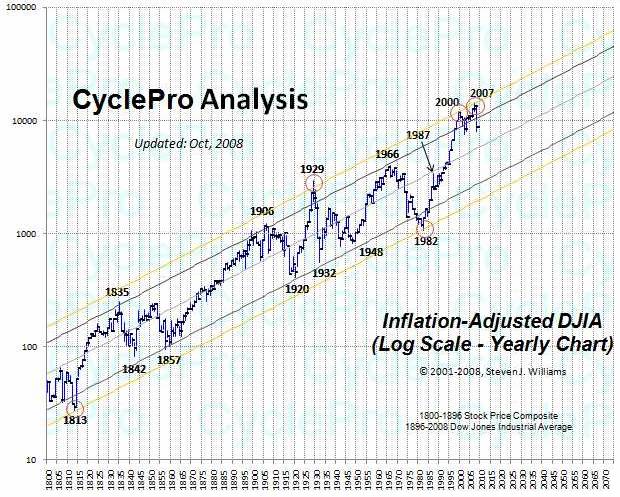

As mentioned in April of 2007,

“When the effects of inflation have been

extracted, the DJIA is much more cyclical than Wall Street promoters would care

to admit.” Steve Williams of Cycle Pro

has updated his inflation-adjusted Dow Jones Industrial Average chart (below)

which we previously cited. The recent sell off seems insignificant when viewed

over the last 200 years. Our target is unchanged; we expect the market to swing

to the lower end of the trend channel.

On the way to the bottom, the market must relieve bearish sentiment (make you forget your fear). It can only do this through sharp powerful rallies (where we all laugh for a day with CNBC on how close we came to the brink). We have described these as “rocket-launched (oh they’ve saved us) bear market rallies.” Investors who cheer these sharp up moves as a sign of the bottom should take note of the chart provided by Tom Denham from Elliotwave.com below.

Protectionism and International Trade

In the Great Depression, international trade was drastically slowed by global protectionism. In the U.S. the Smoot-Hawley Act was credited with the destruction of foreign trade. And while France has begun to threaten tariffs, so far countries have resisted this policy. Instead it is fear in the credit markets that is replicating the effects of Smoot-Hawley. Without Letters of Credit, international trade cannot get done. The Baltic Dry Index, a leading indicator that measures global shipping demand, is down a stunning 90%.

Inflation - Negative Over the Next 5 Years

Because of high debt levels, we have continually warned of a deflationary collapse. Now according to Nouriel Roubini,

“Finally, and more important, yields on Treasury Inflation-Protected Securities (TIPS) due in five years or less have now become higher than yields on conventional Treasuries of similar maturity. The difference between yields on five-year Treasuries and five-year TIPS, known as the break-even rate, fell to minus 0.43 percentage points. This is a record. Since the difference between the conventional Treasuries and TIPS is a proxy for expected inflation, the TIPS market is now signaling that investors expect inflation to be negative over the next five years, as a severe recession is ahead of us.”

TIPS are signaling negative inflation for the next 5 years and inflation below 1% for the next 10 years! Therefore we would like to reiterate our call to investors to preserve their portfolios with U.S. Treasury Bills (interest bearing cash). Higher returns require more risk, which in our view will not be rewarded in this type of environment.

Only

The Treasury Can Print Money

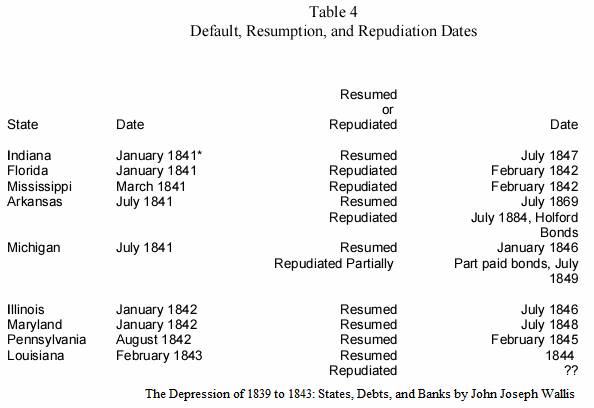

We suspect even the U.S. Treasury will be eventually challenged by this crisis. As we stated in January, we expect long term obligations of the U.S. Treasury to rise in yield. And while the Treasury can print money (which will lead to higher inflation in the long run, no doubt) other entities without the power of the printing press may not be able to raise cash to cover their interest payments. Yes, even raising taxes may not be able enough to cover the debt servicing in a depression (just ask California). Remember the Panic of 1837, that led to a 7 year depression and which we compared to our present times in May 2007? In the paper, The Depression of 1839 to 1843: States, Debts, and Banks, John Wallis notes that “Pennsylvania, Maryland, Indiana, Michigan, Illinois, Arkansas, Louisiana, Mississippi, and Florida all defaulted on their debt in 1841 and 1842.” Five of these ended up repudiating all or part of their debt. The dates are listed below.

With this in mind, yields in the municipal market may not be as rewarding as investors believe. Only the U.S. Treasury can print money.

“I used to think if there was reincarnation, I wanted to come back as the President or the Pope or a .400 baseball hitter, but now I want to come back as the bond market. You can intimidate everybody.” – James Carville

Bailout Bonanza

The government bailout is working just as we expected: It’s making things worse. We don’t know if “making the strong stronger and the weak weaker” was the intent all along or if they actually thought they could bailout the system. It could just be another case of the rule of government meddling (gov’t action produces the opposite effect intended). Once again, these actions have been tried before; the Reconstruction Finance Corporation was established by Hoover in 1932 to make loans to the private sector. It didn’t prevent massive foreclosures or high unemployment back then either. Eventually the program was shut down in 1954. Even Congress finally admitted the loans were made for ‘political reasons.’

At Lamont Trading Advisors, we provide wealth preservation strategies for our clients. For more information, contact us. Our monthly Investment Analysis Report requires a subscription fee of $40 a month. Current subscribers are allowed to freely distribute this report with proper attribution.

***No graph, chart, formula or other device offered can in and of itself be used to make trading decisions. This newsletter should not be construed as personal investment advice. It is for informational purposes only.

Copyright ©2008 Lamont Trading Advisors, Inc. Paul J. Lamont is President of Lamont Trading Advisors, Inc., a registered investment advisor in the State of Alabama. Persons in states outside of Alabama should be aware that we are relying on de minimis contact rules within their respective home state. For more information about our firm visit www.LTAdvisors.net, or to receive a copy of our disclosure form ADV, please email us at advrequest@ltadvisors.net, or call (256) 850-4161.