![]()

A Bull Run?

By Paul Lamont

March 31, 2009

Last month in Panic

Selling Will Lead To a Sharp Bounce, we stated:

"Bearish sentiment is everywhere. Investors have finally realized what we have been discussing for the last two years. And now that we are near a temporary bottom, some investors are taking action. Unfortunately, investors are reacting to the past. They should have been in cash during the downtrend...Instead, investors should be positioning themselves for a counter trend rally: by either not selling their stocks or if they are in cash, by considering market exposure (depending on your risk tolerance)."

With the market up roughly 20% in 2 weeks, investors now want to know how to reallocate their portfolio to profit from the bounce. How sentiment has changed! It is hard to believe that in the beginning of this month, investors were selling their stocks to buy CDs. Because the market has come up so far and so fast we are now less sure that we have established a multi-month bottom. Remember we stated:

"We expect an intense selling Panic in March, much like September’s action. The sell-off should end with the failure of a significant institution. This temporary bottom will support a sharp bounce into the fall."

The sharp sell-off and high bearish sentiment did lead to a bottom on March 6th. But was

that enough? GM would certainly be a significant failure. But it has yet to

happen. So we will take a wait and see approach until the retest of the early

March low. However investors should sell their Bond positions as we continue to expect long

term interest rates to rise despite the Fed’s attempt to manipulate

the market.

How To Prevent Panic

J. Wayne Fears in The Complete Book of Outdoor Survival states;

"Survival instructors teach that the first thing to do once you realize

you are lost is to STOP." STOP stands for Sit, Think,

Observe, and Plan. "By following this simple outline you can

control your urge to panic." Some investors may find this useful as they

examine their recent brokerage statements.

Sit. "By sitting down you can prevent

getting into deeper trouble. This one act can also start the thinking process,

and it suppresses the urge to run or to make hasty decisions. You may need this

time to get over the initial shock that you are lost."

Think. "In a survival emergency, man is at the mercy of his mind.

That is the reason many survival experts refer to the mind as the best survival

kit. In order to survive, one must keep control of the mind by thinking back to

past training, by determination, and by maintaining a positive mental

attitude."

Observe. "Observe your surroundings to discover what problems must

be solved and what resources you have to solve them."

Plan. "Now that you are organized, set plans. Maintain a good

survival spirit. Dispel fears."

Meanwhile, Back at the Ranch

While Bankers have been living the high life (until recently), farmers have been

going through a tough few decades. We found a useful list of "101 Ways To

Save Money" on the Alabama Cooperative Extension System website. But

there have been periods in economic history when farmers and ranchers were considered

the big men of the day. As Jim Rogers has stated, in the next decade the farmers (and not the bankers)

will be driving the Maseratis.

The 200+ year chart below should be helpful in demonstrating why we agree with

Mr. Rogers. Raw industrial prices adjusted for inflation registered extreme

lows in 2000.

Source: The Bank Credit Analyst.

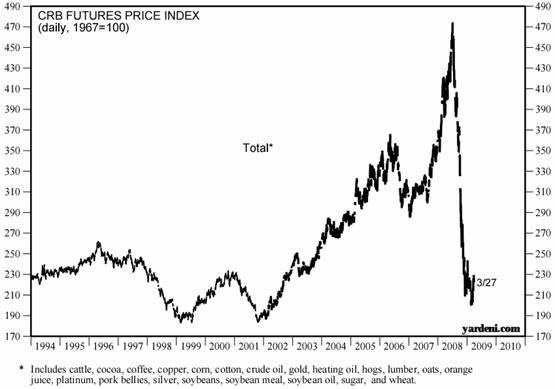

Since that time, some commodities have gone up in a frenzy (which in May 2008 we warned would collapse). And collapse they did! The following chart shows the CRB Index which is near those long term lows once again.

And what can we expect at a major

bottom in commodities? Let us look back to the early 30s, a bottom that

supported a multi-decade commodity bull market.

The Suitcase Farmer

"To begin with, quantities of farmers had lost their farms during the

hideous early years of Depression- lost them by reason of debt. These farms had

mostly fallen into the hands of banks or insurance companies, or of small-town

investors who had held the mortgages on them, or were being held by government

bodies for non-payment of taxes, or had been bought in at tax sales (Since

Yesterday by Fredrick Lewis Allen)."

In addition to farm foreclosure, there was a drop in prices due to a lack of demand (Great Depression) and a drought of epic proportions which led to the Dust Bowl.

"In the callous old Wall Street phrase, the farms of the United States had been "passing into stronger hands"; and that meant that more and more of them, owned by people who did not live on them, were being operated by tenants....More and more the farm owner, whether or not he operated his own farm, was coming to think of himself as a business man, to think of farming as a business. He was less likely to use his farm as a means of subsistence, more likely to use as much of it as possible for the growing of crops for sale...A striking example of this trend was the appearance of the "suitcase farmer" - a small town business man who bought a farm or two, cleared them of houses and barns, spent a few weeks each year planting and harvesting them, (using his own tractor or a hired one), and otherwise devoted himself to his business, not living on the land at all. A Kansas banker told Ladd Haystead, toward the end of the decade, that he estimated that between twenty and thirty per cent of the land in western Kansas was owned by suitcase farmers. This was what was happening to the territory when the victims of drought had fled!" (Since Yesterday by Fredrick Lewis Allen).

And how did this contrarian suitcase farmer fare?

"Farm prices rose. For example, the farmer who had received, on the average, only 33 cents a bushel of wheat in 1933 received 69 cents in 1934, 89 cents in 1935, 92 cents in 1936, $1.24 in 1937 and 88 cents in 1938. The cotton farmer who had received an average price of 5.6 cents a pound for his cotton in 1933 received between 10 and 13 cents during the next four years, and 7.9 cents in 1938."

Let the Bulls Run

The perfect storm that hit Kansas subsistence farmers in the late 20s is

very likely hitting cattlemen this time around. "The bottom of the

cattle cycle is typically marked by a terrible market price wreck when

either drought or feed prices upset the already volatile market pessimism." (Grass

Fed Cattle by Julius Ruechel).

If you follow the links, you will see that both have occurred in the last few

years here in the U.S. Internationally, the drought is much worse in Australia

and Argentina.

And we probably don't have to tell you about recent "volatile market

pessimism." A rancher who has been in the cattle business since the early

1950s, recently told me this is the worse he has ever seen it. Remember cattle

farmers did not participate in the recent commodity run up. It was their costs

(feed and energy) that were rising instead. According to Ruechel,

"The cattle cycle lasts 10 to 12 years typically with a 6- to 7-year herd

expansion phase and a 3- to 4-year herd liquidation phase." How do we know

that Mr. Ruechel

truly understands the market? Because he states many times: "You will

always be rewarded for being out of sync with the masses." He continues;

"the next feeder price low will theoretically happen in 2009 or 2010, with

the next feeder price peak occurring in 2014 or 2015." ‘Stronger

hands’ should take note.

Your Frozen Account Consultant

In January

2007, we stated:

"With the cash you have raised from selling assets, we recommend a portfolio of 3 month U.S. Treasury Bills, which protect principal. We do provide this service, but we want to stress that you can call your financial consultant tomorrow to allocate everything into a U.S. Government-only money market fund. While this is not ideal, it will initially protect investors, until more evidence demands further preservation and our services. History shows that most investors will not take action, but those that do, will be able to eventually buy assets at bargain prices."

After doing a review of the contents of various money market funds, many are still holding short-term debts of the Enron-like entities known as SIVs that hold leveraged mortgage assets. We see no way around money market fund investors taking losses and possibly being faced with frozen funds such as happened to auction rate securities holders. To quote one investor: “It’s a moral outrage...Their pitch was, keep your cash with us, we get a higher rate.” And while we may have a bounce in confidence for a few months, we urge investors to begin the process of moving your cash to higher ground (U.S. Treasury Bills) for the next down leg. If long term interest rates rise as we expect, interest rate derivatives should provide more fireworks for the financial sector.

At Lamont Trading Advisors, we provide wealth preservation strategies for our clients. For more information, contact us. Our monthly Investment Analysis Report requires a subscription fee of $40 a month. Current subscribers are allowed to freely distribute this report with proper attribution.

***No graph, chart, formula or other device offered can in and of itself be used to make trading decisions. This newsletter should not be construed as personal investment advice. It is for informational purposes only.

Copyright ©2009 Lamont Trading Advisors, Inc. Paul J. Lamont is President of Lamont Trading Advisors, Inc., a registered investment advisor in the State of Alabama. Persons in states outside of Alabama should be aware that we are relying on de minimis contact rules within their respective home state. For more information about our firm visit www.LTAdvisors.net, or to receive a copy of our disclosure form ADV, please email us at advrequest@ltadvisors.net, or call (256) 850-4161.