![]()

Crash Opportunities, Part Three

By Paul Lamont

September 19th, 2012

In our last Report we concluded; “There are three markets mentioned above that have already experienced their secular bear market. In our next report, we will highlight these opportunities just as we did in Crash Opportunities Part One and Two in the last cycle.” The three markets are New Zealand, Japan and Taiwan. But these three are not equally attractive. Before we highlight the crash opportunities of today, let’s review the investment themes identified in September 2008.

Crash Opportunities Review

In Crash Opportunities Part One, we focused on the potential for the Yen to continue to appreciate (the USD/JPY to fall from 115). In addition to the Yen being strong, we were pessimistic on the Euro. Another crash opportunity that we uncovered was the possibility that beef and pork prices would rise. And finally for speculative investors who might be positioning for the crash itself, inverse index funds. That was September 3rd. Lehman failed on September 15th. As markets continued in their death spiral, we reiterated our Treasury Bill position in Crash Opportunities Part Two. We also compared gold’s twenty year bear market in the 1980s and 1990s with the recent action of the Taiwanese stock market. Let’s elaborate on that subject.

Gold in the Spring of 2001

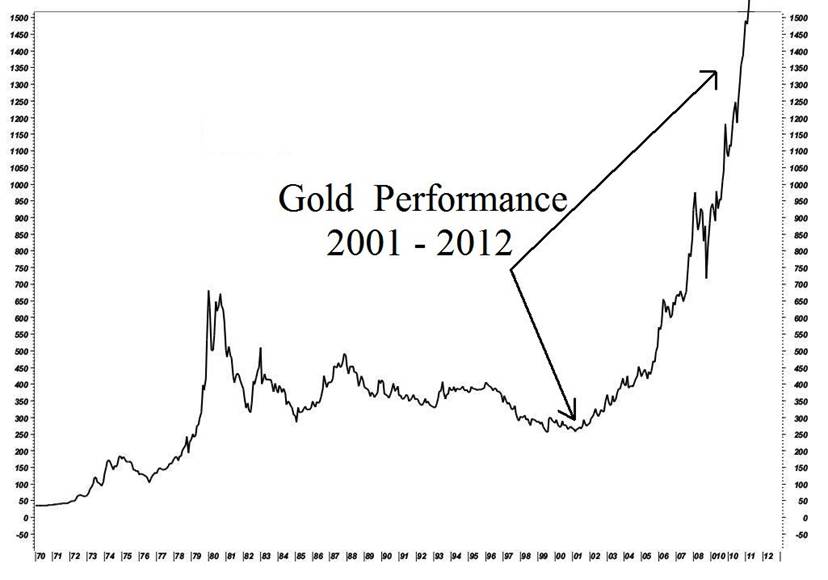

As we stated in Crash Opportunities Part Two: “Markets that have been completely ignored for two decades interest us. After a 20 year bear market, gold has recently done very well.” Below is a chart of the price of gold from 1970 to 2001. In January 1980, the price of gold hit a record $850 an ounce. After the initial crash in the early 1980s, gold traded quietly in a range for the next 15 years. By the Spring of 2001, gold was down to $250 an ounce. Investors who bought gold in 1980, spent 20 years only to lose 70%.

By the Spring of 2001, gold was ignored by most investors. A May 2001 article on MarketWatch captures the attitude toward gold at the time: “It became obvious that gold and commodities trading appealed most to investors with a gambler's get-rich-quick mentality.” Even the professionals had given up: “Many pros told me privately that most of their customers would end up losing all the money they'd invested within 18 to 24 months, then quit.” Almost every paragraph in the 2001 article reinforces gold’s past negative performance. The article concludes: “Gold's glory days are history, today all that glitters may well be fool's gold.” With the gold mining industry dumping over a year’s worth of future production onto the futures market (selling it before it’s out of the ground - in expectation of lower prices) and investors avoiding it like the plague, from that point, the gold price rose nearly vertically for a decade. The chart below shows the move from $250 to off the charts - just over $1900, the most recent 2011 high.

Please go back and read the full 2001 MarketWatch article on gold. If your mouth isn’t watering for gold by the time you finish, we have further work to do. Remember investor interest must be smashed for prices become a bargain. Once prices are a bargain, they have only one way to go. Up.

Lest you think that markets no longer become depressed because of infinite money printing, it is time to return to Taiwan.

Taiwan - The Lonely Island

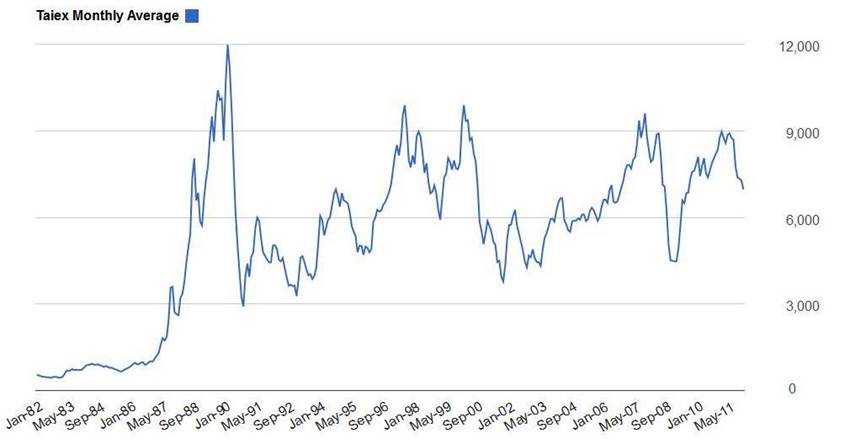

As you can see from the chart below, Taiwan shares experienced a crash in early 1990. They traded quietly in a range for the next 20 years. By the 2008 financial crisis, the Taiwan index was down 68% over 18 years. Compare this to the gold charts above.

Dr. Marc Faber describes the end of secular bear markets in Tomorrow’s Gold:

“The longer phase zero (Ed Note: secular bear market) lasts, and the more depressed the economic conditions and financial assets, the higher the probability of phase one starting, provided that some event will spark an improvement in economic and social conditions. What is, therefore, important for phase one to get underway is a catalyst that will drive the economy out of its lethargy into an initially slow growth phase… Also I cannot stress enough that a new leadership with a vision for economic growth, political unity and social improvement usually works wonders.”

The Catalyst

In 2008, Taiwan elected Ma Ying-jeou, a supporter of closer ties with mainland China. Could this be the catalyst Taiwan needs? As Jim Rogers hoped for back in 2007’s A Bull in China: “Given China’s vast labor force and markets, and Taiwan’s expertise and capital, the two would make a perfect fit. Maybe one of these days, even the Chinese themselves will be calling it a match made in heaven.”

He continued: “Despite remaining bureaucratic hurdles, 213 of Taiwan’s 250 major corporations have already invested in China, according to a survey by the China Credit Institute. These powerful business leaders are the first force pushing for a peaceful resolution to the Taiwan-China conflict. They know better than anyone that poor relations with the mainland have only prevented Taiwan from reaching its full potential. The obvious example is that there are no direct flights yet between the two Chinas….”

Sure

enough, those business leaders demonstrated their influence in 2008. Ma won on

a platform "to connect Taiwan more with

the world.” Ma continued: “we (the new government) will be more

open to expanding the scope of Taiwan and in loosening restrictions in its

economic policies.” Ma called “for

the introduction of direct, regularly scheduled flights to Shanghai and

Beijing” with an “end to Taiwan’s limits on its

companies’ ability to invest on the mainland.” By 2011, three

mainland cities (Beijing,

But it takes more than tourist traps to start a bull market. Recently, the two linked communications and agreed to hold joint maritime drills. Most importantly, formal economic ties have been initiated. After asking if this was “The Birth of A Taiwan Bull?” in May of 2009, we concluded that “When the cycle is ready to turn, the news will follow.” The previous link described, “the first investment by a Chinese state-owned company in Taiwan since a civil war ended six decades ago.” What followed in 2010 does indeed appear to be “a breakthrough deal” for Taiwan. In June of that year, Taiwan and China signed the Economic Cooperation Framework Agreement (ECFA), “that would cut tariffs on a range of goods and services and establish a formal framework for economic ties.”

It’s Not Just China

A better relationship with China is more important for Taiwan than just the trade deals they sign with China. Because of questions over Taiwan’s political status, most countries had been afraid to deal with Taiwan and thus anger mainland China. Taiwan leaders also haven’t attended international summits for the same reason. But the “breakthrough deal” signaled to other countries that it was acceptable to deal with Taiwan independently (i.e. if China can do it, we can do it). It also has given Taiwan renewed confidence.

Since the ECFA was signed, Taiwan has stepped onto the international scene. Taiwan attended APEC, the Asian Pacific Economic Cooperation, with its own envoy. New Zealand and Singapore have both begun trade talks with Taiwan. Recently, the U.S. and Taiwan have planned to resume their talks over their Trade and Investment Framework Agreement. Just last week, the E.U. passed a resolution “which urges the launch of bilateral ECA negotiations and supports Taiwan’s meaningful participation in international organizations.” And even Russia is willing to negotiate energy discounts with Taiwan. After years of isolation, Taiwan is finally emerging onto the international scene.

Fuel for the Boom – Taiwan’s

Financial Sector

According to Dr. Marc Faber, if the transition out of the bear market “is accompanied by an extensive expansion of credit (credit inflation), a powerful boom is likely to get underway.” Obviously, we were interested in June of this year when the Chinese announced they will be providing $95B in loans to Taiwan in exchange for rice. Just this month, Taiwan and China have agreed to directly clear foreign exchange. As noted in the Commercial Times: “Yuan-denominated financial services and products in the future will become a new source of revenue for the island's financial sector.” Taiwan joins the ranks of Macau and Hong Kong as offshore Yuan banking centers. To see this visually, compare the skylines of Macau and Hong Kong with Taipei. We suspect Taiwan’s lonely Taipei 101 tower will soon be getting some company.

Susceptible to Debt Risks?

Most Americans are cautious of the financial sector after the excesses of the last mania. Is there a chance that Taiwan is over-indebted and will be forced to deleverage in a debt crisis? We don’t think so. The Taiwanese people save about 30% of their income (the U.S. came close to this figure in WW2). Currently, Taiwan investors use insurance policies as savings vehicles. This risk-averse attitude is what we should expect after two decades of declining share prices.

The Taiwanese government is just as frugal. Debt is only roughly 40% of GDP (compared to 100% of GDP for the U.S.). The government of Taiwan also has one of the largest gold hoards and one of the largest foreign exchange reserves (savings) in the world. Eventually, western countries will hit their citizens and companies with massive tax increases. Taiwan, because its government does not have a debt or spending problem, will continue to rewards its citizens with spending vouchers.

Both Taiwan citizens and its government are the most financially sound in the world. We have a long way to go before a mania overextends the financial health of Taiwan.

Global Slowdown

Because we are in a global slowdown, Taiwan will continue to suffer along with the rest of us. As a manufacturer and exporter, a recession for Taiwan is likely to be sharp and severe. However without debt issues, Taiwan can recover faster and stronger than debt plagued western countries. We look forward to the continued fall from the 2011 high by world stock markets. It will make Taiwan even cheaper. This Report isn’t called Crash Opportunities for nothing.

Conclusion

Taiwan stocks have been in a secular bear market for over 20 years. This is comparable to gold in the 1980s and 1990s. Long term bear markets provide powerful momentum for up trends. The election of Ma and the change in Chinese policy is the catalyst that will bring Taiwan out of its isolation and long term stock market slump. But first, the current global crisis and panic will provide great (cheap) entry points to take advantage of the emerging long term bull market in Taiwan.

At Lamont Trading Advisors, we provide wealth preservation strategies for our clients. For more information, feel free to contact us. Our monthly Investment Analysis Report requires a subscription fee of $40 a month. Current subscribers are allowed to freely distribute this report with proper attribution.

***No graph, chart, formula or other device offered can in

and of itself be used to make trading decisions. This newsletter should

not be construed as personal investment advice. It is for informational

purposes only.

Copyright ©2012 Lamont Trading Advisors, Inc. Paul

J. Lamont is President of Lamont Trading Advisors, Inc., a registered

investment advisor in the State of Alabama. Persons in states outside of

Alabama should be aware that we are relying on de minimis contact rules within

their respective home state. For more information about our firm visit www.LTAdvisors.net,

or to receive a copy of our disclosure form ADV, please email us at

advrequest@ltadvisors.net, or call (256) 850-4161.