![]()

We Prefer A More Secure Financial

Institution

By Paul Lamont

July 29, 2008

***We are giving away The Investment Analysis Report this month because it deals with such an important topic that is hardly ever discussed: custody of funds. Subscribers will receive a Paypal invoice starting next month.***

Commodities are correcting as forecast. Mainstream journalists are practically replicating parts of last month’s subscription report. As expected, the real economy is ready to tumble without credit flowing from the financial institutions. The FDIC takeover of IndyMac bank does not surprise us either. With IndyMac’s failure, the FDIC deposit insurance fund has been depleted by 8% to 16%, (based on preliminary estimates). Concerns about the $50 Billion dollar fund are causing the FDIC to raise their insurance premium on banks. Also calls to the FDIC helpline have doubled over a year ago according to Reuters. Oddly enough, almost exactly one year ago, we were calling the FDIC helpline researching details for our clients.

CD’s - What A Pain!

The FDIC takeover of IndyMac Bank was far from flawless. We encourage everyone to watch the video. Are you on the list? Frankly, we prefer not to wait in line to get our money. Reports of online banking and ATMs being inaccessible are also a concern. So we recommend that folks have up to two months worth of cash under the mattress or in the cookie jar. Why two months? Because after Sheryl MacPhee, a depositor at IndyMac, received her check from the FDIC, she tried to deposit it at Washington Mutual. WaMu said they would put an eight week hold on the check. (Wells Fargo said it too was placing holds on many IndyMac checks as a precaution.) And this was during only one bank failure. Gerard Cassidy, an RBC analyst, expects “as many as 300 of the country's 8,494 banks and thrifts are likely to fail over the next three years.” We expect quite a few banking holidays as this crisis continues.

Remember CD’s are deposits at a bank (yes they are FDIC insured up to $100,000; make sure you are in the right line and have those forms completed correctly). There is even a scheme called the Certificate of Deposit Account Registry Service (CDARS), which allows investors to insure up to $50M in CD’s spread throughout the country’s banks. Unfortunately, this ‘solution’ does not solve the problem. This isn’t a one bank concern. It’s a devaluation of loan values across all banks. This is a national credit bust, a systemic banking crisis. We do not want to know how much paperwork you would have to fill out to get your money back in the CDARS program in a banking panic. We also hope that one thousand $50 millionaires do not take up the CDARS plan. They could secure the entire current FDIC deposit insurance fund for themselves! Actually, the FDIC can tap the Treasury line of credit after the fund has run dry. (We just wanted to point out how absurd it is to have an insurance system that holds $1.15 for every $100. The FDIC should be abolished, since it only seduces the poor and middle class to rely on poorly managed government services. And it’s always poorly managed, no matter who’s in charge. Communism just doesn’t work.)

Instead, U.S. Treasury Bills (a direct loan to the U.S. Treasury) should be held as cash. T-Bills force the Treasury to pay you on time, allow you to protect billions (buy as many as you like in $1000 increments) and let you maintain full ownership over your funds if held at a Trust Company (more on that later). Why would anyone ever want a CD?

Access To Cash

We prefer to move far in advance of the crowd. But some folks like living on the edge, they will try to jump ship at the last possible moment. For those that love adrenaline, Richard Benson of Specialty Finance Group, LLC suggests five signs that could warn you ahead of time of a problem at your institution:

“1) if a bank shows up on a list of troubled banks, move fast (it only took 10 days for IndyMac Bank to fail); 2) if a bank, brokerage firm or finance company has a stock price of $10 a share or less, try and cut your exposure; 3) if the stock price is $5 or less, proceed as if the company’s’ days are numbered and get your money out; 4) if a bank or brokerage firm has publicly denied rumors more than three times, consider them desperate and run; and 5) if you ever hear a government official come out and say that an institution is fine, you know it’s time to get your money out because history shows they’re likely lying.”

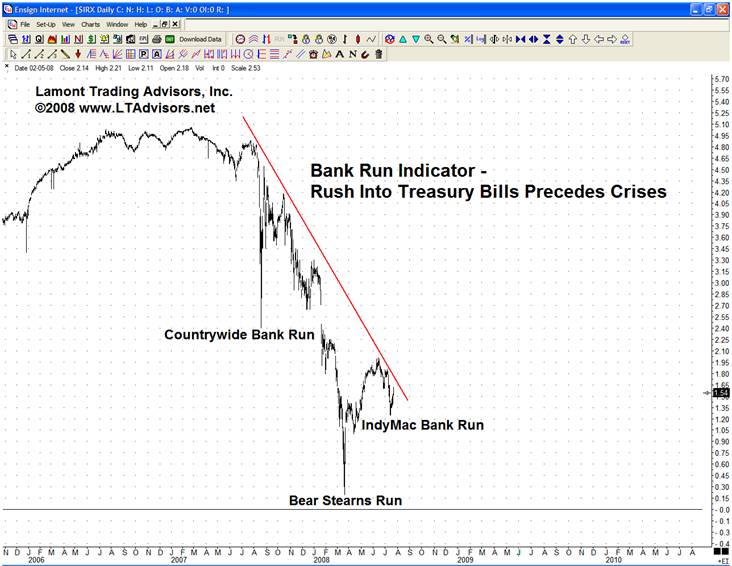

As we pointed out last August, the Treasury Bill Yield shows investors rushing into cash. The yield falls as investors buy T-bills and depositors run. Same action, different venue.

Custody of Funds

As we referenced last April, it is very important in a deleveraging environment to hold your U.S. Treasury Bills at a secure financial institution. Calling brokers and reps up and asking them if your funds are safe at their institution is like asking the fox if the chickens he is guarding are safe. What do you expect them to say? Since we are independent and only work for our clients, we have been diligently researching the different types of asset custodians. Here is what we found:

Trust Company - According to the American Bankers Association: “Assets held in custodial accounts in the trust department of a bank do not become assets of the bank and are segregated from the bank’s assets.” More importantly, “Account ownership in the assets remains vested in the individuals or entities for whose benefit the bank is acting as custodian and the assets are not subject to the claims of creditors.” The FDIC has confirmed this. Since this is the strongest claim of ownership, retirement and high net worth accounts are held in custody accounts at a Trust Company when you open a LTA U.S. Treasury Bill Account.

Brokerage Firm – A conservative brokerage firm is the next step down in ownership claim. Only two brokerages in the country have made it through our selection process (the third we had to pull accounts from due to a merger). Why is this even a concern? Securities held at a brokerage firm are in ‘street name.’ This means they are registered under the name of the brokerage at the DTC, the system-wide clearing company. Brokerages then record on their books that they hold securities for the ‘benefit of the owner’ held at the DTC. What an individual client of a brokerage firm really owns is a percentage of the securities held in the client pool. This is not full ownership. If an investor has a margin account, the brokerage company may lend out those securities. (Even if you do not, but the brokerage firm promotes margin accounts, securities lending could diminish the client pool in a systemic crisis.) Also highly leveraged client bets may create losses that affect the entire client pool, as happened in the failure of MJK Clearing. So in our view, accounts held at Wall Street investment banks and brokerage firms that deal with leveraged players are not secure. When presented with the evidence, most folks would prefer to deal with only highly rated financially stable brokerage firms.

Bank – Frankly, we do not want to be depositors or creditors at any bank. Banks are even wary of lending to other banks. Instead, cash can be held at more secure institutions. Debit card and check writing capabilities can also be obtained at institutions less likely to be ‘bailed’ out by the government. As John Bovenzi, the FDIC's chief operating officer, recently stated: IndyMac bank “is as safe and as sound as any bank in the country right now.” (Cough.) As we discussed two months ago, comparing bank stock prices is the best determinant of financial health if you have to have a bank account. While stock prices can change, perceptions do create reality.

Worst Case Scenarios

We will continue to search for higher ground during this seventy year flood. If you have read our past reports, you know that we try to stay out ahead of the herd. But we also have to admit, that while we are doing everything we can, something may happen that we cannot stay ahead of. This credit crisis is one for the history books. Funds may be unavailable for extended periods of time. So with that, we give you the worst case scenarios:

Trust Company

“Since assets held in trust, fiduciary and custodial accounts do not become assets of the bank (title is held by the account’s owner(s)), it follows that none of this property is subject to the claims of the bank’s creditors. As a result, a failure of a bank will have no adverse effect. In the event that a bank with trust, fiduciary or custodial powers fails, the FDIC will seek to transfer responsibility for administration of the accounts to a successor trust institution as quickly as possible. Provided this effort is successful, the account beneficiaries would need to either accept this new arrangement or make provisions with the successor bank for alternative arrangements. Therefore, the safety of trust, fiduciary and custodial assets is not dependent upon whether the bank has assets greater than its liabilities. Property held in these accounts belongs to the owner(s) of the accounts and would be unaffected by a bank failure.” - American Bankers Association

Brokerage Firm

“When a brokerage firm is closed due to bankruptcy or other financial difficulties and customer assets are missing, SIPC steps in as quickly as possible and, within certain limits, works to return customers' cash, stock and other securities. Without SIPC, investors at financially troubled brokerage firms might lose their securities or money forever or wait for years while their assets are tied up in court. SIPC either acts as trustee or works with an independent court-appointed trustee in a brokerage insolvency case to recover funds. The statute that created SIPC provides that customers of a failed brokerage firm receive all non-negotiable securities - such as stocks or bonds -- that are already registered in their names or in the process of being registered. At the same time, funds from the SIPC reserve are available to satisfy the remaining claims of each customer up to a maximum of $500,000. This figure includes a maximum of $100,000 on claims for cash.” - SIPC

Bank

“Since deposit account assets become assets of the bank, it follows that the depositor would become a creditor in the event a bank failed. However, the FDIC insures depositors for up to $100,000 per individual per bank.” - American Bankers Association

Over-the-limit depositors are at the mercy of the FDIC.

The Fannie Mae and Freddie Mac Solution

“Blessed are the young, for they shall inherit the national debt.” – Herbert Hoover

Of course, the government is going to print. But like an adjustable rate mortgage, the government’s borrowing rate (bond yield) will jump dramatically. We discussed this outlook at the beginning of this year. As mortgage rates are generally higher than a Treasury Bond, the ‘housing bailout’ will cause more problems than solve. As we stated last February, “As a general rule, government policy/central planning produces the opposite effect intended.”

"We have tried spending money. We are spending more than we have ever spent before and it does not work. And I have just one interest, and now if I am wrong somebody else can have my job. I want to see this country prosper. I want to see people get a job. I want to see people get enough to eat. We have never made good on our promises. I say after eight years of this administration, we have just as much unemployment as when we started. And enormous debt to boot." - Treasury Secretary Henry Morgenthau, 1939.

Blue Planet – A Survey of Nature

The ocean and its inhabitants are an apt metaphor for global financial markets. The first twenty minutes of The Blue Planet, a fascinating documentary jointly produced by the BBC and the Discovery Channel, may help investors better understand the financial world. The first clip describes the Federal Reserve’s fiat credit system, economic waves, and global financial centers. The second provides a look at financial market participants, the schooling of financial behavior, and the volatility of bear markets.

What’s Next

We have had quite a move down in the major stock indices over the last two months. We wouldn’t be surprised if we corrected upwards or for a few weeks. This would set up the major down wave for the fall. We hope you are able to secure your funds. If you would like assistance, just contact us. Expect Friday afternoons to get more exciting as that is when the FDIC historically announces bank failures. The fire sale forecast last October continues.

Congratulations

on Your New Home, Glad We Could Make Your Day!

Perhaps you would humor us by filling out our quick survey to better understand our current online readership. This will allow us to improve The Investment Analysis Report. We appreciate any feedback.

At Lamont Trading Advisors, we provide wealth preservation strategies for our clients. For more information, contact us. Our monthly Investment Analysis Report requires a subscription fee of $40 a month. Current subscribers are allowed to freely distribute this report with proper attribution.

***No graph, chart, formula or other device offered can in and of itself be used to make trading decisions. This newsletter should not be construed as personal investment advice. It is for informational purposes only.

Copyright ©2008 Lamont Trading Advisors, Inc. Paul J. Lamont is President of Lamont Trading Advisors, Inc., a registered investment advisor in the State of Alabama. Persons in states outside of Alabama should be aware that we are relying on de minimis contact rules within their respective home state. For more information about our firm visit www.LTAdvisors.net, or to receive a copy of our disclosure form ADV, please email us at advrequest@ltadvisors.net, or call (256) 850-4161.