![]()

‘Day Traders 2.0’ Will Tank

Your IRA

By Paul Lamont

March 31, 2010

A constant theme in the Investment Analysis Report has been to expect the market to move in the opposite direction of the positions of day traders. This has proven successful with regards to the Japanese Yen, the U.S. dollar and the Treasury Bond. Therefore, we were very interested in the New York Times article Day Traders 2.0. We expect that day traders, who are now buying stocks, are again on the wrong side of the trade.

The New York Times provides some statistical research on a day traders’ success rate. Not surprisingly, in a “yet-to-be-published study conducted in Taiwan…the authors sifted through tens of millions of trades, from 1992 to 2006, and found that 80 percent of active traders lost money.” With that kind of win/loss ratio, it is no wonder that “’only 1 percent could be called predictably profitable,’ says a co-author, Brad M. Barber, a finance professor at the University of California, Davis.” A day trader’s failure is as close to a statistical certainty that you will find in this life. These speculators show up en masse when they are most comfortable investing, which turns out to be at the end of a trend. As the NY Times concludes, the day trading philosophy “is a Newtonian principle formulated more than 300 years ago: a body in motion tends to stay in motion.” Price momentum reinforces herding and blinds speculators to any trend change.

Recently, “many of the new day traders are people who recently lost jobs and can’t find work…They’ve got a severance package or a nest egg that they want to invest themselves.” We are reminded of the lithograph ‘The Way to Grow Poor and The Way to Grow Rich’ included in our 2007 Report, “China and the Crash of ‘29.”

While that particular comparison was deemed extreme at the time, the Shanghai index fell roughly 70% during the 2007-9 crisis. China has since traded a stock market bubble for a real estate mania.

The Chinese Boom Goes South

According to Edward Chancellor, author of the must-read Devil Take The Hindmost: A History of Financial Speculation, in China “last year, new bank lending increased by nearly RMB 10 trillion, a sum equivalent to 29% of GDP.” To put this into perspective, if the U.S. experienced a 29%-of-GDP increase in lending, our top 15 banks’ loan portfolios would double in size. With that kind of credit expansion, it is no wonder that in the southern Chinese province of Hainan apartment prices are up 50%. The NY Times reports: “there are the property speculators flying to this resort town from across China with bagfuls of cash, to buy apartments whose cost per square foot rivals parts of Manhattan.” “Buyers from other provinces even remitted money to the property developer of a project before it was built.” As usual in a mania, it’s the sellers who make all the money, but only if they get out free and clear before prices fall. As ‘famed short-seller’ Jim Chanos recently stated, China “is Dubai times 1000.”

But before you rush off to the beaches of southern China with your bagfuls of cash, we would like to note that bank lending has recently contracted, residential sales are temporarily banned, builder and lending stocks have sold off and Fannie Mae-like infrastructure entities sponsored by the states have lost their federal support.

Since Chinese banks are refusing to lend to their own people, loan dealers are now selling Chinese development loans to foreign pools. This was precisely what Wall Street did in 2007; it sold the last and most toxic subprime loans to European banks. Recall it was UBS’s loans that were the first to blow up.

Like the U.S. in 2008, Chinese financial institutions and builders will be severely impacted by the real estate bust. Also as Dr. Marc Faber recently noted, a Chinese crash would be “a disastrous environment for industrial commodities.” According to Kenneth Rogoff, former chief economist at the International Monetary Fund, the fallout would “cause a recession everywhere surrounding the country, including Japan and South Korea, and be ‘horrible’ for Latin American commodity exporters.” We agree with these assessments and expect losses to come to light by early 2011.

Back in the U.S….S.R.

It appears the United States and China have traded places. Our expectation for the U.S. stock market is similar to our 2007 Chinese equity forecast. This time around a massive credit crunch will develop in China and a stock market crash will hit America.

In addition, the U.S. banking system is likely to need another massive bailout due to the double dip in U.S. housing. Sales of new homes have fallen to a 46 year low and existing home inventory jumped in February at the fastest rate in 20 years. Financial analyst Meredith Whitney is certain that housing will double dip at this point. After examining bank balance sheets, former TARP Czar Neil Kashkari went and built a cabin out in the woods of California. He stated that night in the California wilderness "makes $700 billion seem small." We suspect $700B will indeed seem small after all the banking losses are fully revealed.

Shock in Ireland

As we stated in Further than Most Expect, “the central planners may try to “manage” things, but contagions could result quickly from panics in Ireland, Spain, Germany, U.K, Iceland, and/or yes even Estonia (chart below).” So it’s no surprise to our subscribers that Ireland must “pour billions of dollars into their banks.” The “truly shocking” bailout on March 30th doubles the country’s national debt. As Irish Finance Minister Brian Lenihan describes, “At every hand's turn, our worst fears have been surpassed.”

Citigroup

The Treasury Department recently announced that they planned to sell their Citigroup stock. When asked about Citigroup, Elizabeth Warren, Congressional Oversight Chair head of the TARP commented: “You know, Citi’s numbers keep moving around so much… I don’t know. Uh. They’ve got to finish this plan. I can’t quite get my arms around the business plan and what the vision of this business post a 40% shrinkage looks like. I’m just not quite there yet.” Not exactly a vote of confidence. Citigroup’s stock price peaked out last August.

What’s Next

While our forecast for a U.S. dollar rally proved correct, financial losses in Europe have yet to affect U.S. equities. But it is only a matter of time. As we mentioned two months ago:

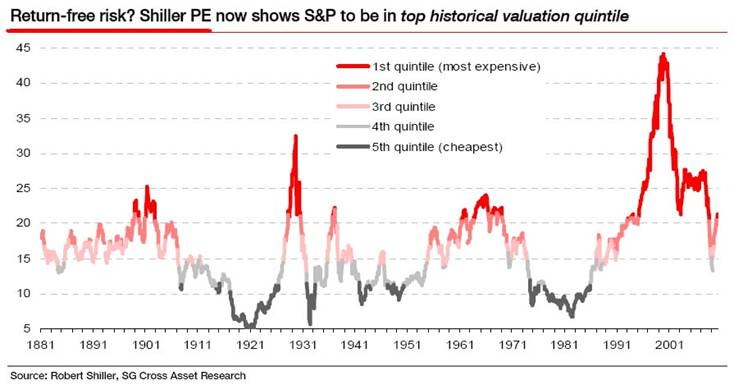

“While we prefer the Q ratio, the cyclically adjusted price to earning ratio from Robert Shiller (shown below) accurately reflects the full cycle of stock market expectations. If the market “took investors to the clouds” in 1929, stockholders back in 2000 entered the ionosphere. It should be of no surprise that since that time investors have been continually disappointed.”

As Societe General's Dylan Grice points out: “According to Robert Shiller’s latest data, the S&P500 is back in its highest valuation quintile. The risk is there - as it always is - but the returns aren’t. So what do you do? Go take a holiday if you can.”

The chart below shows the P/E

ratio in its highest quintile, which according to Grice implies a 1.7% annual

return over the next 10 years.

At these valuations, the stock market reminds us of the 30 yr-Treasury Bond back in December of 2009. At that time, the Treasury was offering investors a mere 2.5% annual return on your money for 30 years. Ninety-nine percent of day traders surveyed thought this was a good deal then. Of course, they were wrong. Bond prices went down 20% and the government now offers a 4.7% yield for 30 yrs. In our view, buying the S&P500 for a 1.7% return over the next 10 years is a similarly bad deal. But the day traders are loving it once again.

‘A Dream That is Not Going To Come True For Any But the Tiniest

Fraction’

Warren Buffett once argued against gambling in Nebraska. His points are applicable to Wall Street. As we wait for the stock market to deflate, we offer this quote from John Rothchild:

“By December 30, 1929, the stock market was happily on its way to regaining a third of its losses. Enough confidence was restored that the so-called Crash was knocked off the front page of Barron’s by a crisis in South American Bonds. That the Dow Jones Averages didn’t reach a low point until 1932, three years after the supposedly disastrous date, should be very reassuring to us all. There was plenty of time for the investing public to sell its stock and suffer a normal setback - a 50 percent loss at the most.” A Fool And His Money: The Odyssey of an Average Investor. John Rothchild, 1988.

Unfortunately, few did. Most sold in the Panic of 1932, when the market was down 85%.

At Lamont Trading Advisors, we provide wealth preservation strategies for our clients. For more information, feel free to contact us. Our monthly Investment Analysis Report requires a subscription fee of $40 a month. Current subscribers are allowed to freely distribute this report with proper attribution.

***No graph, chart, formula or other device offered can in and of itself be used to make trading decisions. This newsletter should not be construed as personal investment advice. It is for informational purposes only.

Copyright ©2010 Lamont Trading Advisors, Inc. Paul J. Lamont is President of Lamont Trading Advisors, Inc., a registered investment advisor in the State of Alabama. Persons in states outside of Alabama should be aware that we are relying on de minimis contact rules within their respective home state. For more information about our firm visit www.LTAdvisors.net, or to receive a copy of our disclosure form ADV, please email us at advrequest@ltadvisors.net, or call (256) 850-4161.